Comment choisir une casquette respirante pour l’été ?

Avec l’arrivée des beaux jours, se protéger du soleil devient une priorité, mais combiner protection et style peut s’avérer être…

Lire la suite

Croisières de rêve : top destinations à découvrir

Imaginez-vous à bord d’un navire haut de gamme, un cocktail à la main, voguant vers des destinations exotiques où le…

Lire la suite

Guide des meilleurs produits high tech pour faire le bon choix !

Les gadgets high-tech sont devenus des must have pour mener une vie connectée. Les smartphones et leurs composants sont d’ailleurs…

Lire la suite

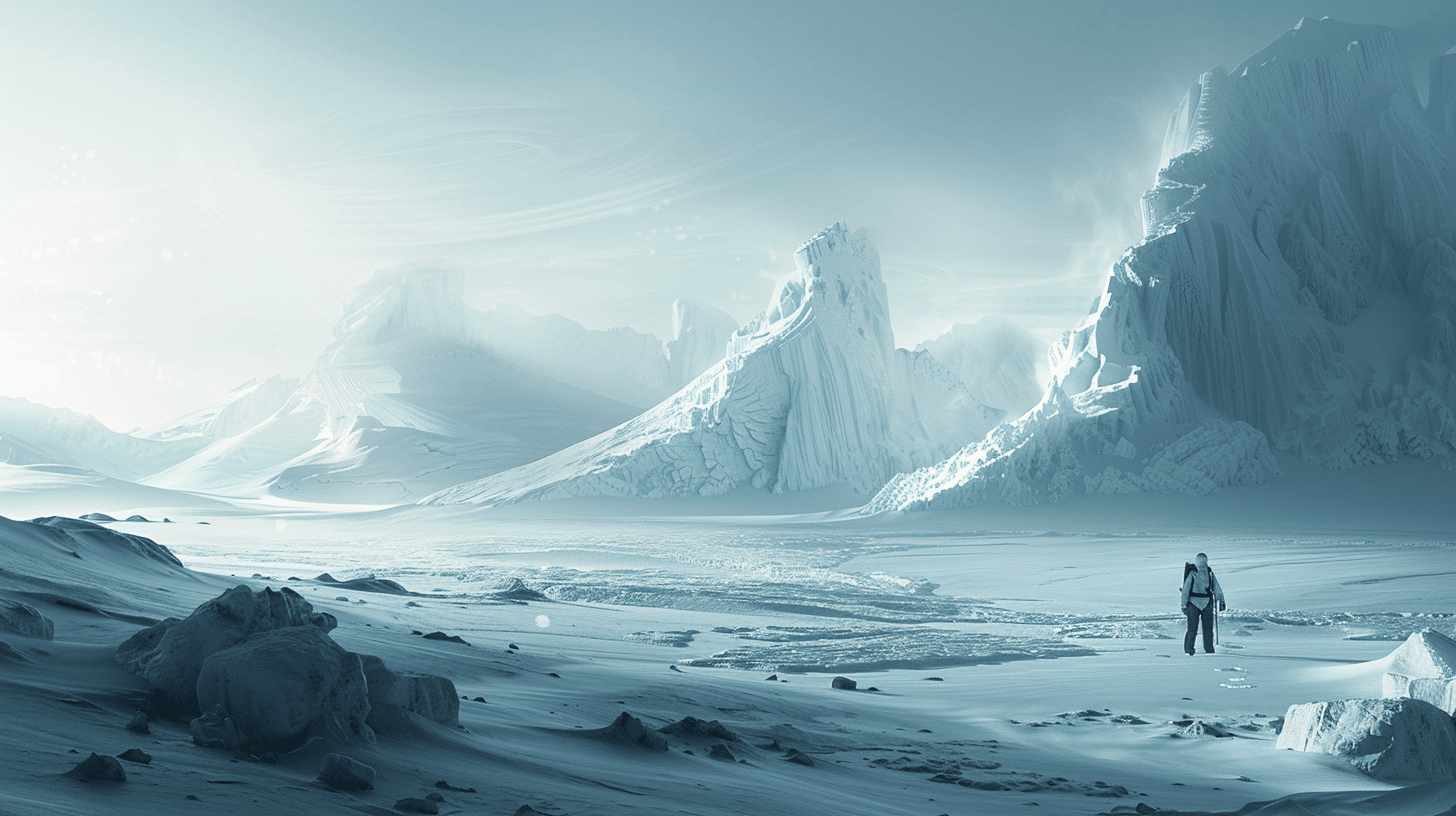

Guide essentiel pour préparer voyage en antarctique

Prêt à braver le froid glacial de l’Antarctique ? Ce guide essentiel détaille les étapes pour organiser votre expédition au…

Lire la suite

ingénieur géomètre : quelles compétences doit-il avoir ?

Dans le monde de l’ingénierie, spécialisé et extrêmement technique, l’ingénieur géomètre se distingue par son rôle crucial dans la conception…

Lire la suite

Guide pour investir facilement et en confiance les options pour les epargnants

Investir peut sembler un défi, surtout quand on débute. Ce guide éclaire les épargnants novices sur les options d’investissement simples…

Lire la suite

Comment fonctionne les sites de recrutement à Guéret ?

Savoir maîtriser les outils de recherche d’emploi en ligne est essentiel, surtout à Guéret. En effet, vous devez comprendre les…

Lire la suite

Alimentation : les bienfaits des oméga 3 sur la santé

La quête d’une alimentation équilibrée vous intrigue? Les oméga 3, vous connaissez certainement de nom, mais saisir leur impact réel…

Lire la suite

Achat de feutres : les différents types proposés sur le marché

Adeptes de dessin, professionnels de la création ou simples passionnés de coloriage, le choix du bon feutre peut transformer votre…

Lire la suite

Mon-maillot-de-bain.com : La meilleure boutique de maillots de bain en ligne

La recherche du maillot de bain idéal peut s’avérer être un véritable casse-tête. Entre les différentes tailles, les modèles, les…

Lire la suite

Les différences clés entre MetaGPT et les plateformes de développement d’applications Web traditionnelles.

Dans un univers digital en constante mutation, le développement web prend de nouvelles tournures avec des avancées technologiques surprenantes. L’arrivée…

Lire la suite

Quels sont les systèmes de sécurité les plus performants contre la cybercriminalité?

À l’aube de l’ère numérique, le monde des affaires s’est transformé de manière irréversible. Des données précieuses flottent désormais dans…

Lire la suite

Découvrez comment apprendre le français facilement : techniques et astuces infaillibles

Maîtriser une nouvelle langue peut souvent sembler une montagne insurmontable. Pourtant, l’apprentissage du français se révèle bien plus aisé avec…

Lire la suite

Peut-on annuler un devis d’artisan après acceptation ?

L’excitation de transformer sa maison en un cocon de rêve est palpable. Vous avez parcouru des dizaines de sites à…

Lire la suite

Comment entretenir ses stores?

Lorsque l’on évoque le confort et l’esthétique d’un intérieur, il est essentiel de ne pas négliger les détails, comme l’entretien…

Lire la suite

Découverte du camping à Lanaudière : votre guide ultime pour l’aventure en plein air

Voyager, c’est toquer aux portes du monde ; y faire rimer aventure avec nature, c’est l’engagement du voyageur écoresponsable. Prêts…

Lire la suite

Guide de choix d’un barbecue à gaz idéal

Quand le soleil pointe le bout de son nez et que les journées s’allongent, l’envie de grillades en plein air…

Lire la suite

Connaissez-vous les offres de formations sur Dijon ?

À Dijon, une variété d’offres de formation est disponible pour répondre à divers besoins éducatifs et professionnels. Que vous recherchiez…

Lire la suite

Quelle est la meilleure période pour faire du camping à Damgan ?

Ah, Damgan ! Ce nom évoque les embruns salés, le chant des mouettes et le doux clapotis de la mer…

Lire la suite

Cours de piano particulier à Strasbourg : Par où commencer ?

De nombreux Français s’adonnent à la pratique musicale en tant que loisir. Parmi les instruments les plus prisés dans l’Hexagone,…

Lire la suite

Quelles sont les mesures de sécurité dans les campings Tikayan du Var ?

À l’ère où le tourisme de plein air connaît un véritable engouement, et où les familles cherchent à allier détente…

Lire la suite

Astuces pour utiliser une boule puante pour ses farces avec ses amis

Vous cherchez à surprendre vos amis avec une farce hilarante qui les marquera ? Maîtriser le lancer d’une boule puante…

Lire la suiteQuels bénéfices peut-on tirer de la formation d’un groupe d’entreprises ?

La création et la gestion d’un groupe d’entreprises s’avèrent être des décisions stratégiques cruciales pour assurer une solide progression sur…

Lire la suite

Comment nettoyer les yeux d’un chien ?

Lorsqu’il s’agit du bien-être de votre compagnon à quatre pattes, les soins oculaires ne devraient pas être pris à la…

Lire la suite

Harnais pour Chat: Confort & Sécurité

Lorsque vous décidez d’adopter un chat, c’est tout un monde qui s’ouvre à vous, un monde de tendresse, de ronronnements…

Lire la suite

Quelle nourriture choisir pour les poissons?

Dans le monde fascinant de l’aquariophilie, la question de l’alimentation occupe une place centrale. Que vous soyez un aquariophile chevronné…

Lire la suite

Pourquoi avez vous absolument besoin d’une assurance professionnelle ?

Lorsque vous exercez une activité professionnelle, il est essentiel de vous protéger contre les risques auxquels vous pourriez être confrontés.…

Lire la suite

Quels Critères pour Choisir le Bon Consultant SEO pour Votre Entreprise ?

Le monde du référencement web est vaste et complexe, et lorsqu’il s’agit de propulser votre entreprise au sommet des résultats…

Lire la suite

Rendez inoubliables vos vacances en campings à Annecy

L’air frais des Alpes, le scintillement des eaux cristallines du lac d’Annecy et l’horizon dessiné par des sommets majestueux… Imaginez-vous…

Lire la suite

Spa Var : pour des instants de détente et de bien-être

La région du Var, célèbre pour sa beauté naturelle et son climat méditerranéen, a su s’imposer comme une destination incontournable…

Lire la suite

Pourquoi faut-il installer des bornes escamotables hydrauliques ?

Lorsqu’il s’agit de contrôler l’accès et d’assurer la sécurité des zones sensibles, les bornes escamotables hydrauliques offrent une solution à…

Lire la suite

Trouvez le cadeau Pat Patrouille parfait selon votre occasion

La Pat’ Patrouille, cet ensemble héroïque de chiots mené par le jeune Ryder, a conquis les cœurs des enfants du…

Lire la suite

Commencez par introduire les bénéfices d’une décoration personnalisée dans une chambre d’étudiant

Lorsqu’on est étudiant, la chambre est bien plus qu’un simple espace de repos : c’est un refuge, un lieu d’étude…

Lire la suite

Hébergeur VPS : guide pour bien s’orienter

Quand il s’agit de sécuriser vos données, tous les hébergeurs ne se valent pas. Dans le contexte de l’incendie d’OVH…

Lire la suite

Les établissements qui proposent un recrutement dans le monde de la restauration

Parcourez cette sélection exclusive d’établissements prestigieux qui peuvent vous offrir des opportunités de recrutement dans le monde de la restauration.…

Lire la suite

Visitez votre boutique bohème préférée en achetant votre tenue de plage

À l’approche des vacances d’été ou des escapades hivernales vers des horizons ensoleillés, la quête de la tenue de plage…

Lire la suite

Comment réduire les déchets de cuisine avec le Lombricompostage : Conseils pratiques

Dans une époque où la prise de conscience environnementale devient cruciale, les gestes simples du quotidien prennent une ampleur significative.…

Lire la suite

Sites de rencontre : sont-ils encore efficaces ?

Dans une époque où la technologie est reine et où les interactions sociales ont largement migré vers le virtuel, il…

Lire la suite

Y a-t-il des restrictions de bruit dans les campings de l’Île de Ré ?

L’Île de Ré, cette petite perle de la Charente-Maritime, est réputée pour ses plages de sable fin, ses villages pittoresques…

Lire la suite

Quels sont les événements incontournables des bourses motos en février?

Les bourses motos, ces lieux de rassemblement pour passionnés de deux-roues, sont le théâtre d’échanges, de ventes et de rencontres…

Lire la suite

Jeux : Comment se procurer les accessoires de fléchette ?

Les jeux de fléchettes, mêlant habileté et convivialité, s’imposent comme une activité intemporelle appréciée de tous. Cependant, pour tirer pleinement…

Lire la suite

Qu’est-ce qui est autorisé dans les bagages à main avec easyjet

Voyager léger et efficacement est devenu une sorte d’art, et choisir le bon bagage peut faire toute la différence entre…

Lire la suite

Innovation et design : les dernières tendances en matière de pergolas bioclimatiques

La pergola bioclimatique représente une véritable prouesse dans l’univers de l’aménagement extérieur, combinant esthétisme, praticité et respect de l’environnement. Véritable…

Lire la suiteQuelle est la légalité des fleurs des plantes médicinales dans différents pays ?

Le monde du cannabis et de ses dérivés évolue rapidement, notamment avec la popularisation du CBD ou cannabidiol. Au cœur…

Lire la suite

Que doit-on savoir des défis liés à l’emploi public ?

L’emploi public est confronté à des défis uniques à l’ère moderne. Alors que les gouvernements du monde entier s’efforcent d’offrir…

Lire la suite

Cadeau zéro déchet: la solution pour faire des cadeaux et protéger l’environnement

Dans un monde où la consommation effrénée met chaque jour un peu plus en péril notre environnement, faire des choix…

Lire la suite

Saint Valentin à Caen : Où manger pour un restaurant Romantique ?

Caen, cette perle de la Basse-Normandie, brille de mille feux lorsqu’il est question de raviver la flamme de l’amour. Alors…

Lire la suite

Quels sont les avantages d’utiliser un chauffage à bois?

Dans une époque où la durabilité et l’efficience énergétique sont des priorités, se tourner vers des solutions de chauffage plus…

Lire la suite

Quels sont les tarifs des campings à Vensac, Gironde ?

La Gironde, avec ses étendues de vignobles ondulants et ses plages bordant l’océan Atlantique, est une destination de choix pour…

Lire la suite

Pourquoi s’intéresser au gaming?

Dans un monde où le digital s’impose comme la nouvelle norme, le gaming est devenu un phénomène culturel majeur. Il…

Lire la suite